Customs declaration service

Concept about customs declaration

Customs declaration means doing the necessary customs procedures when exporting - importing goods. Those are the necessary procedures to export/enter into goods and means of transport a country or import/exist to a country’s border.

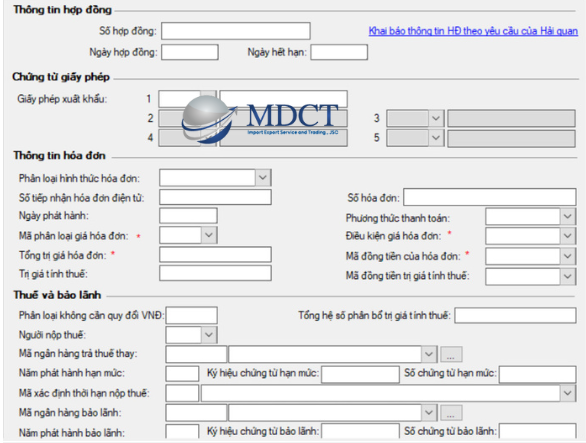

Customs declaration form

Customs declaration service

Customs declaration service means a service to do customs procedures on behalf of businesses. If you are a new business or a household business, and you don’t have experience with the customs declaration, your business can outsource a third party like MDCT Logistics to carry out and complete those procedures, instead of your business having to learn and perform the operations according to the complicated customs declaration process.

MDCT Logistics provides a customs declaration service, on behalf of customers to carry out correct customs procedures. Therefore, our customers can avoid risks when transporting goods and ensure the fastest transporting schedule.

Common difficulties in customs declaration

Why should you choose the customs declaration service of MDCT Logistics?

Types of imported items that MDCT Logistics provides customs declaration support services for businesses:

Necessary documents